SOL, FET, RENDER: Top cryptocurrencies to watch this week

A rebound from the broader cryptocurrency market triggered a $170-billion recovery in valuation, spiking the market cap 8% to $2.26 trillion.

Here are some of the most notable movers to watch this week.

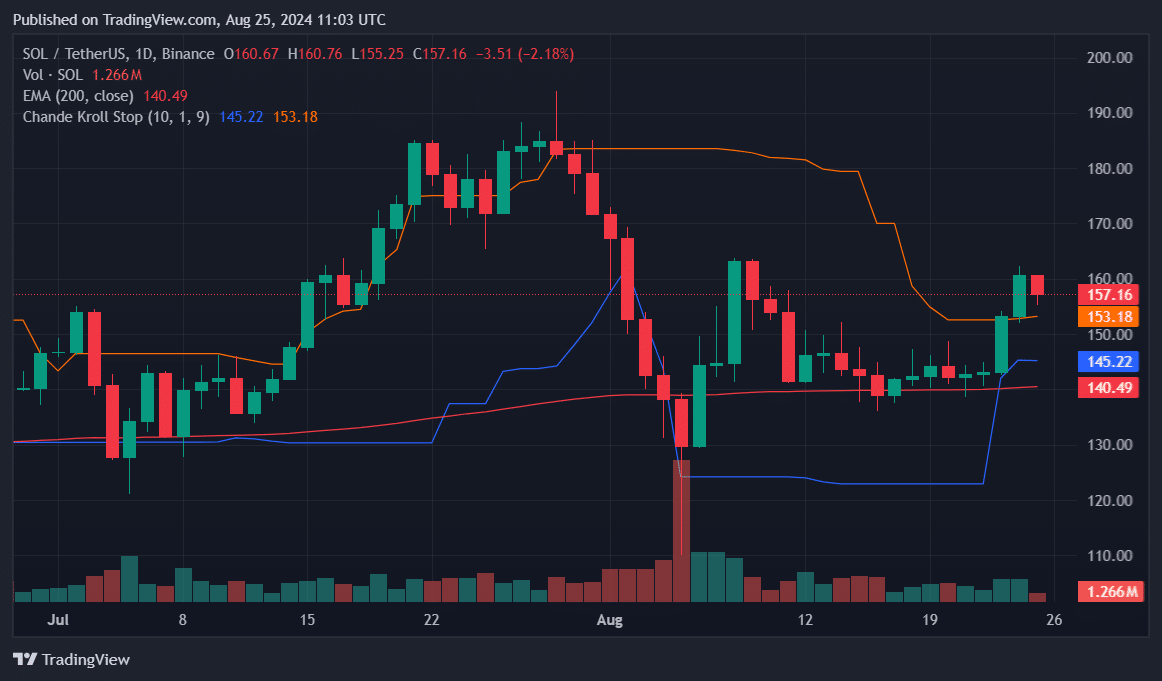

Solana reclaims $160

Last week, Solana sol-0.72%Solana surged 12%, reclaiming the $160 level and peaking at a two-week high of $162 on Aug. 24 despite setbacks in its ETF product. After closing the week strong, SOL has now pulled back to $157.17.

However, Solana remains above the 200-day EMA at $140.12, signaling ongoing bullish momentum. This week, SOL needs to hold above the 200-day EMA to sustain the ongoing upward trend.

Meanwhile, the Chande Kroll Stop indicators place the Stop Long at $145.22 and the Stop Short at $153.18. Maintaining above $153.18 is key for further gains, as a breach could lead to a bearish reversal.

This week, investors should watch for a retest of the $160 and $162 resistance zones or a decline toward key support at $153.18.

nbsp;

Get to know Trustleak

Trustleak crypto signal is a service which provide profitable crypto and forex signals. Trustleak tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Trustleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +100 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Trustleak and get more information about us only need to follow trustleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Trustleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

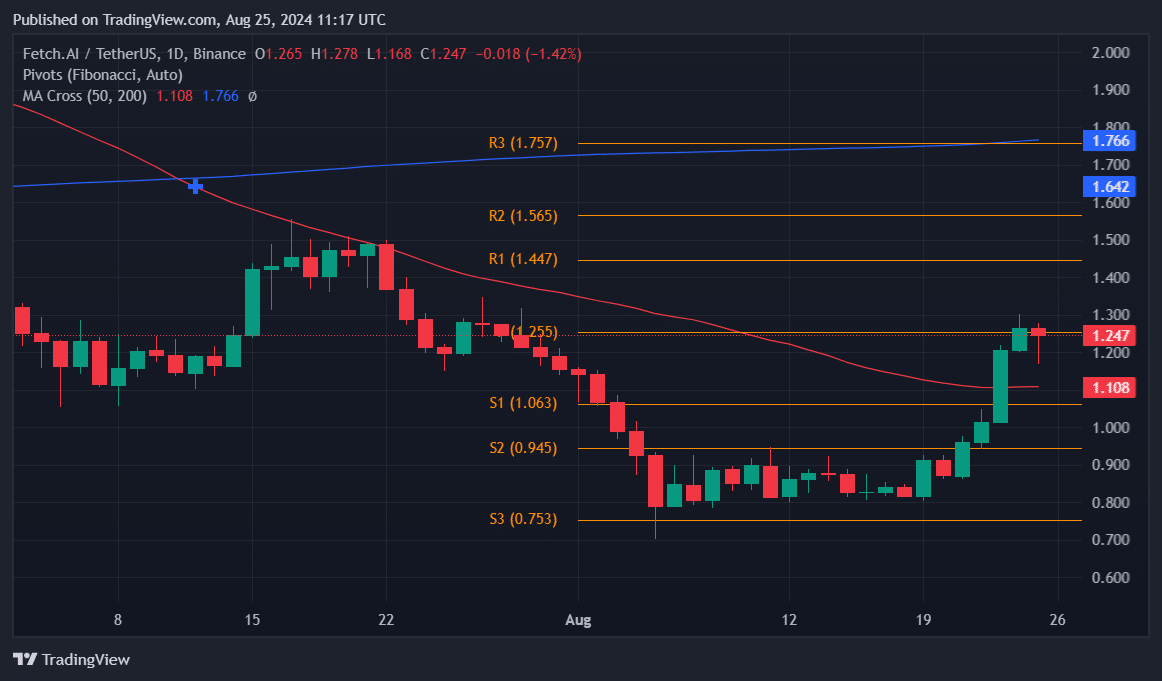

FET spikes 50%

Fetch.ai ![]() fet8.89%Artificial Superintelligence Alliance closed last week as one of the top gainers, spiking 50% and reclaiming the $1 level. On Aug. 24, FET reached a monthly peak of $1.3 but has since retraced to $1.249.

fet8.89%Artificial Superintelligence Alliance closed last week as one of the top gainers, spiking 50% and reclaiming the $1 level. On Aug. 24, FET reached a monthly peak of $1.3 but has since retraced to $1.249.

FET currently trades above the 50-day EMA ($1.108), signaling midterm bullish momentum. However, it remains below the 200-day EMA ($1.766), indicating lingering long-term bearish sentiment.

FET’s immediate resistance points this week are at $1.447 and $1.565, with strong support at $1.063 and $0.945, with a pivot level of $1.255. A break above the resistance could target the 200-day EMA, while failing to hold support would lead to a drop below the 50-day EMA.

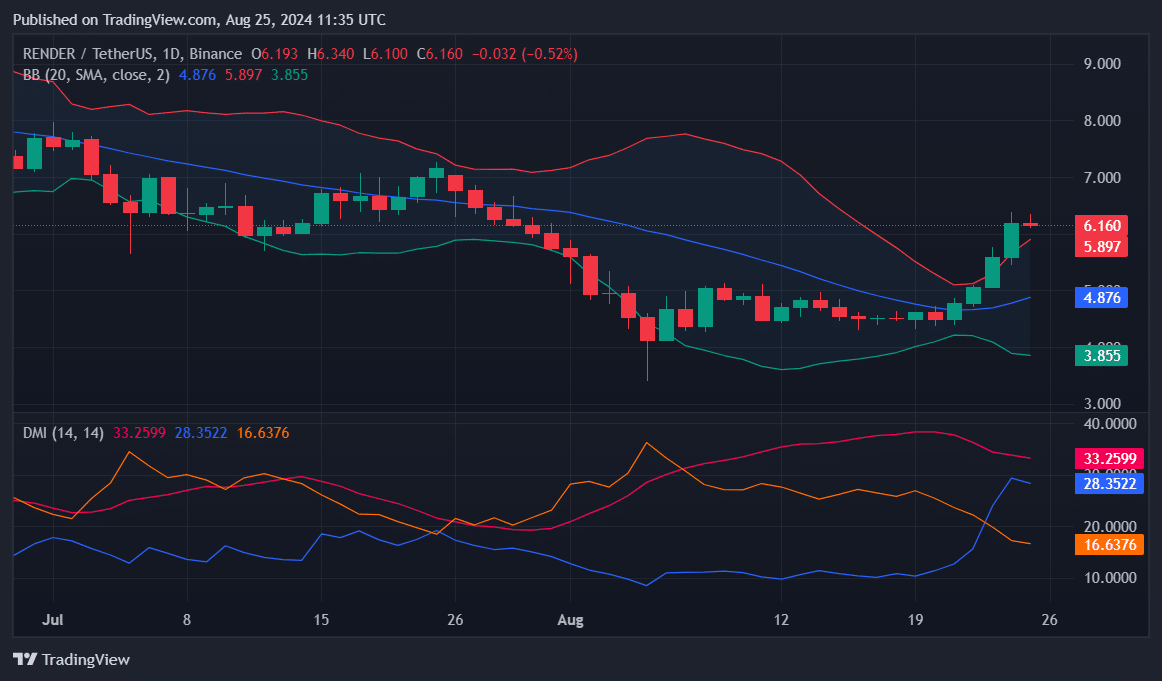

RENDER breaches upper Bollinger Band

Render ![]() render-0.32%Render saw a 37% rise last week, reclaiming the $6 level for the first time this month.

render-0.32%Render saw a 37% rise last week, reclaiming the $6 level for the first time this month.

Currently trading at $6.153, RENDER is comfortably above the Upper Bollinger Band ($5.894), which often signals overbought conditions. This suggests a potential pullback or consolidation might be on the horizon.

However, the strong trend indicated by the ADX at 33.25 supports the idea of sustained upward momentum. The asset maintains a bullish bias with the +DI at 28.35 and -DI at 16.63.

If the current momentum holds this week, Render could aim for higher targets around $6.5 and potentially $7.0.

Nonetheless, a dip below the Upper Band might lead to a retest of the 21-day moving average ($4.875).